Back Office

An efficient and effective Investment Administration solution

FPM is an innovative Investment Administration system that utilises current technology to provide a functionally rich and versatile platform, from which portfolios, client relationships and processing tasks can be automated and managed.

Whether you are a niche manager or a large corporation, FPM is scalable and adaptable to suit your Investment Administration requirements.

Features include:

Multi-currency Fund Accounting

- Automated daily workflows streamline complex processes and provide transparency and control while reducing errors

- FPM’s Fund Accounting is designed from the ground up with reasonability checks and validations in place at every step in the workflow

- Reverse and roll-back features update accounts in real time

- Enhanced communications to all stakeholders through automated distribution or online reporting of tailored financial data report packs

24x7 Real-time Transaction Processing

- Transaction processing, corporate events, accrual processing, market data, valuations and fund accounting including all related static data such as portfolios, instruments, counterparties and bank accounts

- Real time update of data provides immediate reporting which is available 24×7

Wide range of Instrument types

FPM handles a comprehensive range of instrument types including Equities, Unit Trusts, Property, Futures, Options, Moptions, Forex, Bonds, VCBonds, Floating Rate Bonds, Inflation Linked Bonds, Discount and Simple Interest Money Market and Swaps

Graphical workflows & Unitised Pricing

- Fast and efficient automated workflow for Bulk Pricing of multiple Unit Trusts and other unitised portfolios simultaneously

- Tiered structure of unit priced (Fund of Funds) portfolios with look through to underlying portfolios

- Includes processes such as income and expense accruals, allocation of income and expenses across classes, pricing calculations, reasonability checks and distributions

- Colour coded process blocks highlight progress and support drill down to the results and underlying calculations

- Daily tasks such as Interest accrual and payment processing, Corporate Actions, Mark to Markets etc. can also be automated via the graphical and customisable Day Process, together with various steps to check reasonability of data as well as triggers to extract or import data for integration

- Processing and reversing of workflows, and authorisation of various steps, allows for full control over data processing

Reconciliations

- Automated Cash, Scrip and Market Value reconciliations

- Integration with the major Banks

Asset Look-Through

- Ability to “look through” to the underlying securities held in portfolios

- Identify and aggregate exposures at any level of direct or indirect ownership

Integrated Regulatory calculations and reporting

- Dividends and Interest Withholdings tax

- S24J accruals

- CGT

- ASISA, SARB and FSB reporting

- Automated price, trade and distribution integration with Finswitch including tax bucket reporting

General Ledger

- General ledger accounting including balance sheet, income statement and Trial Balance

- Flexible Chart of Accounts for interfacing to a corporate GL

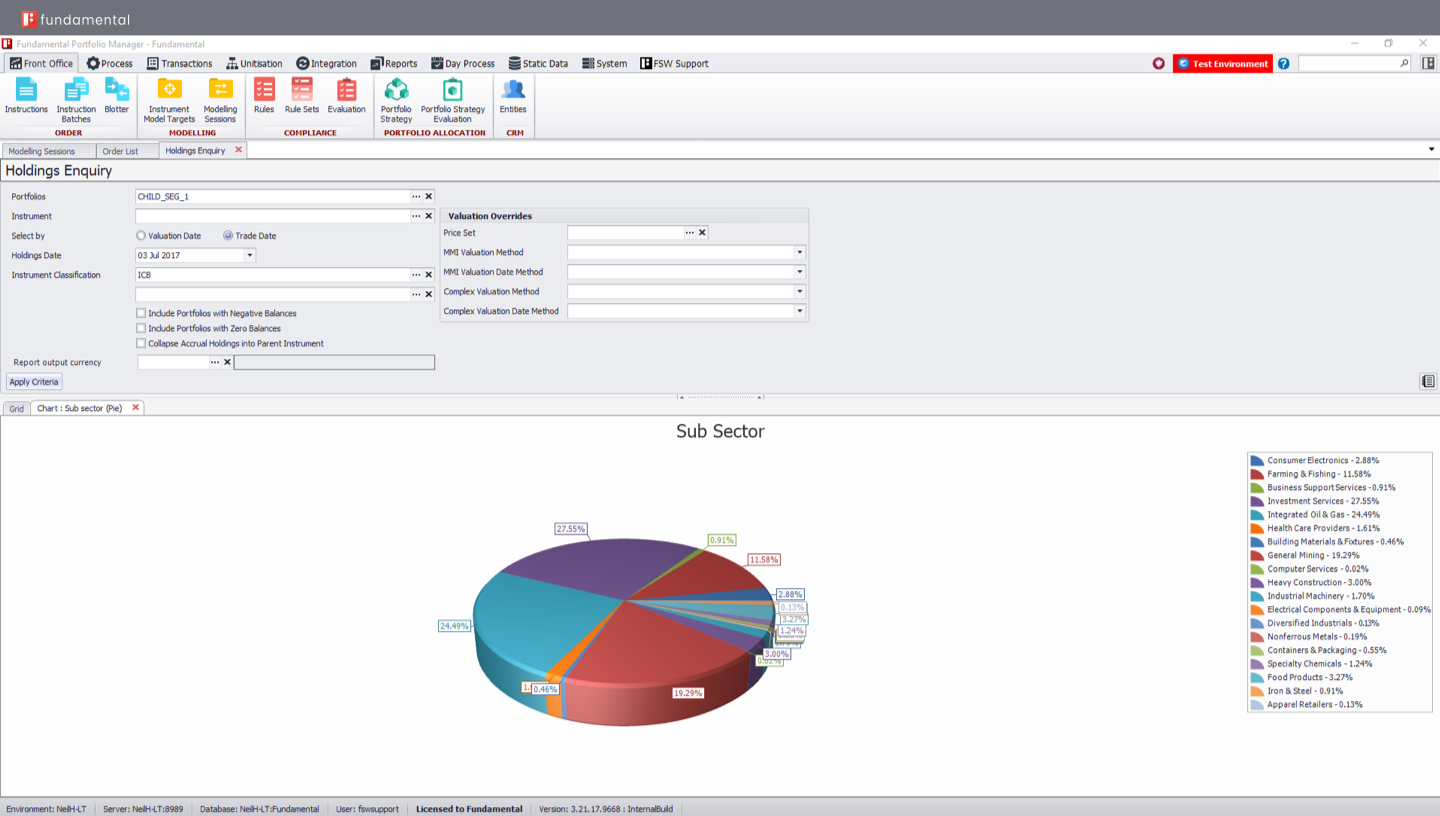

Flexible access to information

FPM’s modern technology provides easy, customisable access to information with the ability to export to excel etc. Grid based enquiries include the ability to select and arrange columns, filter, sort, graph and export data to excel. FPM’s published API’s support easily extracting data and viewing on any device

Easy importing of data

FPM’s ETL tools support easily building automated interfaces to efficiently import data such as market data, transactions and static data. Interfacing methods include webservices, SFTP, polling and triggering and supported formats include JSON, Excel and XML. The Web App supports importing data from mobile devices

Customized Reporting

FPM’s published APIs support easily extracting data and building customised reports. Reports can be automatically generated and distributed via email, SFTP, webservices etc. in various formats (JSON, Excel, pdf etc.). The Web App supports stakeholders viewing Reports on their mobile devices

Integration

FPM’s flexible ETL tools support easily integrating FPM with third-party systems. Integration can be done in various formats including JSON, Excel and xml via MQ or webservices. FPM has existing interfaces with many third party vendors including most of the major banks, SWIFT, JSE BDA, ASISA, Finswitch, Calastone, INET, Bloomberg, StatPro and Charles River